Banking

A bank is a financial institution that provides services. Banking institutions accept deposits, make loans, offer checking and savings accounts, and provide other financial services.

The Canadian banking system is one of the most stable and efficient in the world. It is stable because it has strong regulation, a low level of debt, and a high degree of consolidation. It is efficient because of a number of factors like technology, strong competition, and a well-educated workforce.

The first banks were created in ancient times, when people began to deposit their gold with temples and other safe places for safekeeping. The first modern banks were created in the early 1600s in Europe. BMO, the first bank in Canada, was created in 1817 in Montreal.

The bank began issuing paper currency in 1822. The Bank of Upper Canada followed suit in 1824. The Canadian banking system underwent a major reorganization in the late 1800s and the Bank of Canada was established in 1867 as a central bank. The banks of Montreal and Toronto were merged in 1885 to form the Canadian Bank of Commerce. The Bank of Nova Scotia was established in 1832. The Great Depression of the 1930s had a major impact on Canadian banks. Many banks failed during the Depression, and the Canadian banking system was not able to recover until the 1950s.

The most important legal document regulating banking in Canada is the Bank Act. The Bank Act is a federal law that governs all banks in Canada. It sets out the rules and regulations that banks must follow, and it gives the federal government the power to regulate the banking industry.

What are the Main Types of Banks in Canada?

The main types of banks in Canada are chartered banks, foreign banks, and credit unions:

- Chartered banks are incorporated under the federal Bank Act. They are regulated by the federal government and are the largest type of bank in Canada.

- Foreign banks are incorporated outside of Canada. They are regulated by their home country’s government, not by the Canadian government.

- Credit unions are not-for-profit organizations that are owned and controlled by their members. They are regulated by the provincial or territorial government where they operate.

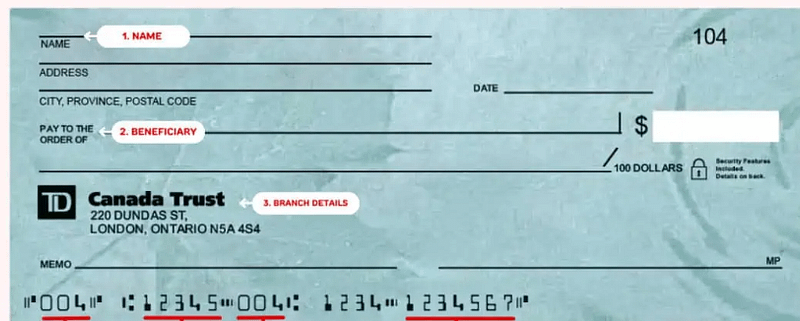

Decoding The Power Of The Void Cheque In The Canadian Financial Landscape

In the vast landscape of Canadian finance, one often stumbles upon the enigmatic entity known as the “void cheque.” From its peculiar name to its mysterious purpose, this humble piece of paper holds significant influence within the Canadian banking system. Today, we embark on a journey to demystify the void cheque, unveiling its essence and

TD Void Cheques In Canada, Explained

In today’s fast-paced financial landscape, managing your money efficiently is essential. Whether you’re setting up direct deposits, authorizing automatic bill payments, or simply verifying your account details, void cheques play a crucial role. Among the various financial institutions in Canada, TD Bank stands as a reputable choice for many Canadians. In this comprehensive guide, we

Desjardins Void Cheques: A Guide For Canadians

In the realm of personal finance, having a solid understanding of banking procedures and tools is essential. One such tool that holds great importance for Canadians is the Desjardins void cheque. Whether you need it for setting up direct deposit, linking accounts, or verifying your banking information, a void cheque can be a powerful ally.

What is a Transit Number in Canada?

Are you looking to make a money transfer or set up direct deposit for your paycheck in Canada? If so, you may have come across the term “transit number” and wondered what exactly it is and how it’s used. In this blog post, we’ll delve into the world of Canadian transit numbers and explain everything

What is a Financial Institution Number (FIN) in Canada?

If you’re a Canadian resident or business owner, it’s likely that you’ve come across the term “Financial Institution Number” or FIN at some point. But what exactly is a FIN? How does it apply to you? The short answer is that The FIN is the 3-digit number identifying a financial institution. It is for example

How To Deposit A US Cheque In Canada?

Are you in need of depositing a U.S. dollar cheque in Canada, but not sure how to go about it? No need to worry – it’s actually quite a simple process! Here’s a step-by-step guide on how to deposit a USD cheque in Canada: 1. Verify If Your Bank Can Deposit A US Dollar Cheque